Multi-scale representation of high frequency market liquidity

Abstract

We introduce an event based framework mapping financial data onto a state based discretisation of time series. The mapping is intrinsically multi-scale and naturally accommodates itself with tick-by-tick data. Within this framework, we define an information theoretic quantity that characterises the unlikeliness of price trajectories and, akin to a liquidity measure, detects and predicts stress in financial markets. In particular, we show empirical examples within the foreign exchange market where the new measure not only quantifies liquidity but also seems to act as an early warning signal.

1Introduction

The notion of market liquidity is nowadays ubiquitous. It quantifies the ability of a financial market to match buyers and sellers in an efficient way without causing a significant price move thus delivering low transaction costs. It is the lifeblood of financial markets (Fernandez, 1999) without which market dislocations can show as for example in the 2008 crisis (Brunnermeier, 2009), but also in many others cases that go unnoticed but are potent candidates to become the next crisis. While omnipresent, liquidity is an elusive concept. For instance, the foreign exchange (FX) market with its impressive daily turnover of $5.3 trillion (Bank of International Settlement, 2013) is mistakenly assumed to be always extremely liquid since the generated volume is considered as a proxy for liquidity but regularly shows illiquid episodes as illustrated through the selected examples below.

Despite the obvious importance of liquidity there is little agreement on the best way to measure and define it (von Wyss, 2004; Sarr and Lybek, 2002; Kavajecz and Odders-White, 2004; Gabrielsen et al., 2011). Liquidity measures can be classified into different categories. Volume-based measures: liquidity ratio, Martin index, Hui and Heubel ratio, turnover ratio, market adjusted liquidity index (see Gabrielsen et al., 2011, for details) where, over a fixed period of time, the exchanged volume is compared to price changes. This class implies that non-trivial assumptions are made about the relation between volume and price moves. Other classes of measures include price based measures: Marsh and Rock ratio, variance ratio, vector autoregressive models; transaction costs based measures: spread, implied spread, absolute spread or relative spread; or time based measures: number of transactions or orders per time unit. There exists plenty of studies that analyse measures of liquidity in various contexts (see von Wyss, 2004; Gabrielsen et al., 2011, and references therein) without reaching a true consensus. In addition, it is worth highlighting that some of the data used in these measures could be hard to obtain or even not available at all as it is the case for the full limit order book in the FX market making therefore impossible the use of a majority of these measures.

From our point of view, the aforementioned approaches suffer from a major drawback. They provide a top-down approach to explore financial markets where the impact of the variation of liquidity is analysed through macroscopic assumptions rather than providing a bottom-up approach where illiquid times are identified and quantified from its possible constituents. The former therefore requires one to make appropriate, and non-trivial, assumptions about the macroscopic system while the latter needs us to identify the right constituents of the system as well as quantifying their dynamics.

Hence this paper aims at looking at liquidity from a different angle where multi-scale price moves are analysed through an event based framework. It allows us to track price moves occurring at different scales (see details below) and, as we shall see, quantifying the unlikeness of these price moves leading to a novel measure of illiquidity as the unlikeliness of the price trajectory with respect to a Brownian motion. We shall observe below the ability of our measure to detect and predict stress in financial markets, illustrated by examples within the FX market, only requiring asset prices as an input.

The document is organised as follows; Section 2 describes the event based framework. Section 3 defines the state based discretisation of price trajectory movement termed intrinsic network. In Section 4 we derive the transition probabilities of the Markov chain modelling the transitions on the intrinsic network, for the case of a Brownian motion. Section 5 describes the information-theoretic concept that characterises the unlikeliness of price trajectories and quantifies illiquidity. Finally, in Section 6 we demonstrate the measurements ability to quantify liquidity during extreme price movements and illustrate the behaviour of the new measurement by focusing on well documented financial crises.

2The event based framework

Traditional high frequency finance models (Dacorogna et al., 2001) use equidistantly spaced data for their inputs, yet markets are known not to operate in a uniform fashion: during the weekend the markets come to a standstill, while unexpected news can trigger a spur of market activity. The non-uniformity is expressed in the markets through the so-called stylized facts, consisting of long range memory in volatility (Poon and Granger, 2003), non-stationary fat tailed distribution of returns (Mandelbrot, 1963), nonlinear serial dependencies in returns (LeBaron, 1994), volatility seasonality (Dacorogna et al., 2001) and scaling in financial time series (Glattfelder et al., 2011b). The idea of modelling financial series using a different time clock can be traced back to the seminal work of Mandelbrot and Taylor (1967) and Clark (1973), advocating the use of transaction and volume based clock. One other area of research that analyses high-frequency time series from the perspective of fractal theory was initiated by Mandelbrot (1963). This seminal work has inspired others to search for empirical patterns in market data - namely scaling laws1. One of the most reported scaling laws in financial markets (Müller et al., 1990; Galluccio et al., 1997; Dacorogna et al., 2001; Di Matteo et al., 2005) relates the average absolute price change 〈Δx〉 and the time interval of its occurrence Δt

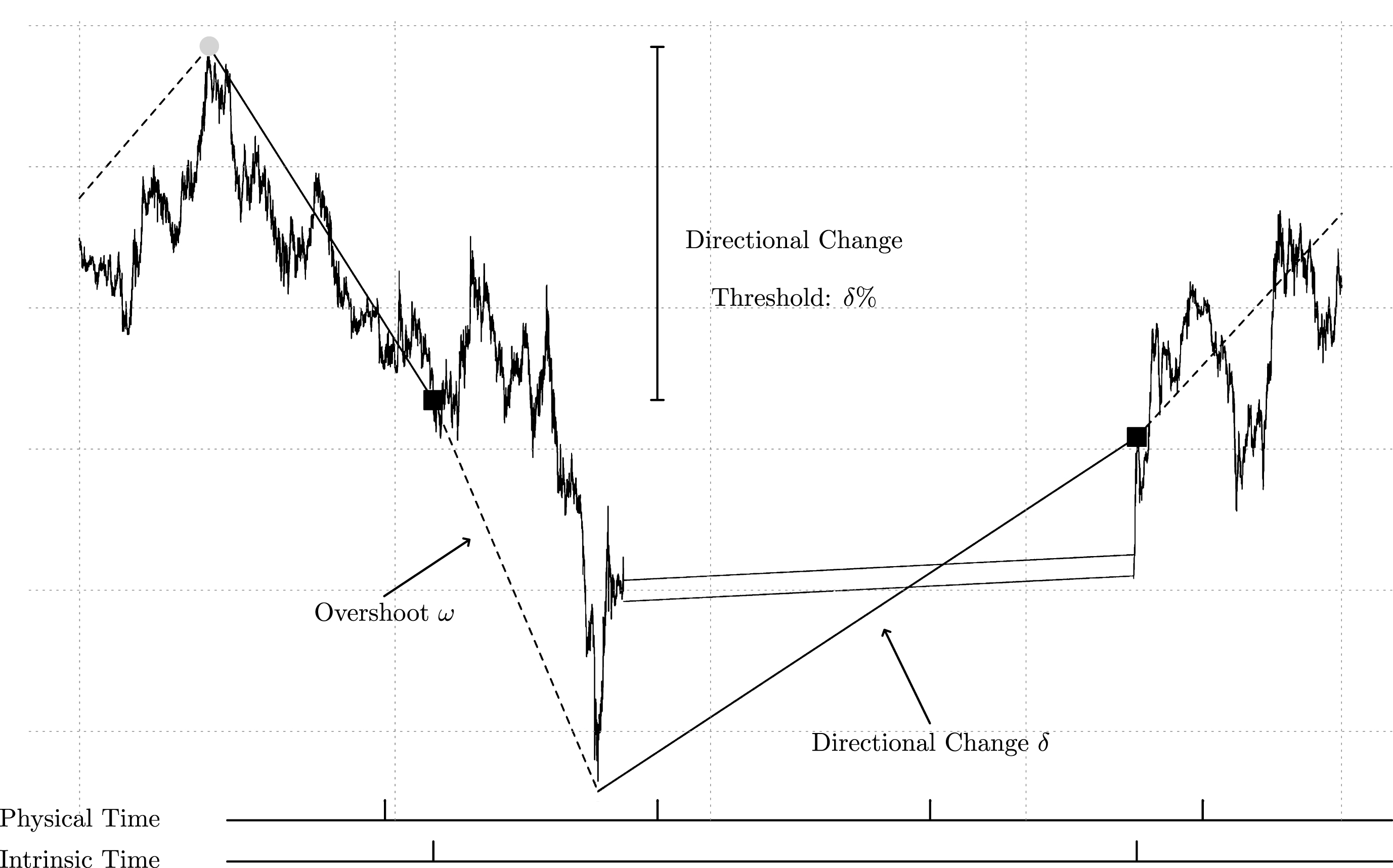

The discovery of a scaling law that relates the number of rising and falling price moves of a certain size (threshold), produced an event-based time scale named intrinsic time that ticks according to an evolution of price moves (Glattfelder et al., 1997). The intrinsic time dissects the time series based on market events where the direction of the trend alternates, see Fig. 1. These directional change events are identified by price reversals of a given threshold value set ex-ante. Once a directional change event is confirmed an overshoot event begins and continues the trend identified by the directional changes. An overshoot event ends when the opposite directional change occurs. With each directional change event, the intrinsic time ticks one unit (Glattfelder et al., 2011a).

Figure 1 shows a price curve with its many peaks and valleys. We choose a threshold of δ > 0 percent of the data series. The detailed sampling rule is as follows - we start in the upward mode - we queue all the recorded prices one by one and keep in memory the highest price; as soon as the price drops by δ, then this is the first intrinsic event and we sample this data point. We discard the old queue and now start a downward queue. We keep in memory the lowest observed data point until we record an up move of δ; this is then the second intrinsic time point. The data series thus determines the pace of sampling and generates itself the intrinsic event-based time scale; the method is endogenous of the price.

The benefits of this approach in the analysis of high-frequency data are threefold; firstly, it can be applied to non-homogeneous time series without the need for further data transformations. Secondly, multiple directional change thresholds can be applied at the same time for the same tick-by-tick data. And thirdly, it captures the level of market activity at any one time.

Financial markets are noisy by nature and are therefore expected to oscillate around price levels. Such oscillations produce alternating directional changes which thresholds reflect the noise amplitude. In between any two directional changes shows an overshoot, as previously described, that length reflects the ability of buyers and sellers to agree upon prices. A long overshoot is then susceptible to be the footprint of a lack of liquidity. We will later show that our intuition of illiquidity is indeed suitable, since we shall observe in section 6 that long overshoots exhibit during market liquidity crisis episodes.

3The intrinsic network

The concept of intrinsic time is self-similar, i.e. fractal and described by few scaling laws as seen above. What is occurring at a certain threshold is similarly occurring at another. This activity is happening simultaneously without however being synchronised: a set of thresholds may exhibit up moves whereas other scales may be in down moves. Representing such a rich activity is cumbersome when not handled in an appropriate framework. This is the subject of this section where we introduce the so-called intrinsic network that not only elegantly handle the activity but also precisely quantify the unlikeness of price trajectories.

We consider n ordered thresholds δ1 < δ2 < … < δn that dissect the price curve into directional changes of fixed length δi and overshoots ωi of varying length. We assign the states of the market for a directional change threshold δi either to be 1 or 0, depending whether the corresponding overshoot is moving upwards or downwards. At each time we assign a binary vector b = (b1, …, bn) consisting of 1 or 0, describing the market over various scales. The binary encoding b = (b1, …, bn) therefore expresses the state of the market s in numeric terms as follows s = b1 · 20 + b2 · 21 + … + bn · 2n-1. We will interchangeably use both notations and it is straightforward to notice there is a total of 2n possible states.

A large enough price move makes the market state to evolve in two possible ways. Firstly, in any state a move in the time series of the opposite direction would first flip the smallest b1, flipping a previous move down b1 = 0 into an upward state b1 = 1, and similarly a move down would flip the first state b1 = 1 state into an b1 = 0 state. In case the time series continues with the move in the same direction, it would flip the first state bi that shows the opposite direction, bi = 0 would flip to bi = 1, likewise bi = 0 to bi = 1. The precise rule is then

b = (b1, …, bn) can transition to

Defining W as the transition probability matrix of the underlying stochastic process, we have created the so-called intrinsic network

The intrinsic network exhibits a couple of peculiar states where the network is non-reactive: the downward blind-spot (0, …, 0) where a downward price move has no effect and, conversely when the market can keep on moving down and the upward blind-spot (1, …, 1) when the market can keep on moving up without being traced. From a blind spot, the available transition is unique; (1, 1, …, 1) can only to transition to (0, 1, …, 1) and (0, 0, …, 0) to (1, 0, …, 0). Regardless of the dimension of the intrinsic network, blind spots will be present, and do present a flaw that will be addressed in the future.

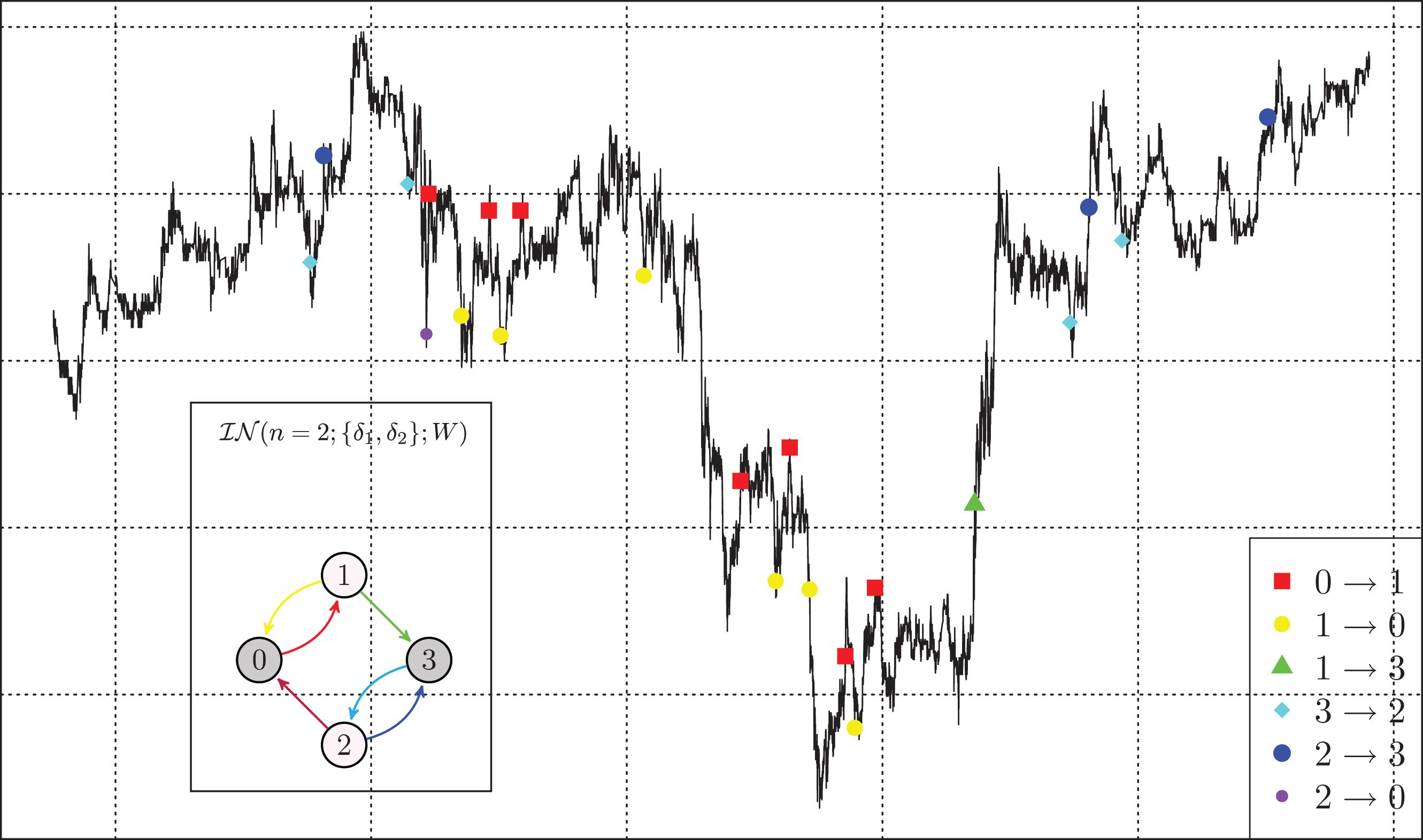

Figure 3 demonstrates an example of transitions on a 2-dimensional intrinsic network for a given time series.

4Transition probabilities

In this section we compute the transition probabilities W corresponding to the intrinsic network. We assume that the price obeys a Brownian motion and that the transitions are modelled as a first order Markov process. We will use these probabilities to compute the unlikeliness of a price trajectory mapped onto the intrinsic network, Brownian motion being used as the reference model of a liquid market.

Firstly, we stress that given a Brownian motion modelling the price

(1)

Secondly, we have conducted numerical simulations for price process with time-varying volatility and concluded that the distribution of overshoot length did not change with introduction time-varying volatility. In what follows we shall therefore consider a Brownian motion with constant volatility, i.e.

(2)

We now present the analytical expressions for transition probabilities.

Theorem 4.1. Let δ1 < … < δn be directional change thresholds of an intrinsic network

(3)

(4)

(5)

(6)

It is remarkable to note that Theorem 4.1 does not depend on volatility for which proof is given in Appendix C.

In addition we stress that it is certainly possible to assume different price generating processes at the cost of losing analytic tractability. Another possibility is to estimate the transition probabilities from empirical data. In what follows, however, we choose to use Theorem 4.1 corresponding to a Brownian motion with constant volatility.

We have numerically checked that the transition probabilities presented in Theorem 4.1 are in good agreement with Monte Carlo simulations considering Brownian motion as an underlying process. The small observed discrepancy is mainly due to the Markovian assumption made to derive Theorem 4.1. We have indeed noticed that a Brownian motion on a network is in fact non-Markovian, it has memory. However this assumption and its related error appear to only marginally affect our liquidity measure.

5Price trajectory unlikeliness

Here we introduce the quantity

We first consider the surprise γij (Cover and Thomas, 1991) of a transition from state si to state sj as

(7)

We further define the surprise of a price trajectory within a time interval [0, T] that have experienced K transitions as

(8)

(9)

(10)

Since the number of transitions is a variable, some time periods might exhibit large surprise purely due to large number of transitions. In order to remove this effect we center the surprise by its expected value, the entropy rate multiplied by the number of transitions K · H(1), and divide it by the square root of its variance, the second order of informativeness multiplied by the number of transitions

(11)

Following (Pfister et al., 2001), the entropy rate of the Markov chain equals

The expression (11) allows us to introduce liquidity

(12)

To summarize, we have mapped any price trajectory onto an intrinsic network modelling the underlying process as a first order Markov chain, and derived the transition probabilities for the case of a Brownian motion. We defined the surprise of a sequence of transitions that we normalised so as it follows a normal distribution. Finally we quantified liquidity by assessing the likelihood

6Empirical analysis

In this section we present the liquidity

6.1Dataset

The data used in this study is quoted by Oanda (Oanda, 2015), one of the major market makers which proposed stable spreads until December 2012. The data set represents the quotes of the major currency pairs from 2006-01-01 to 2014-11-01 at the finest resolution: tick-by-tick. Each tick contains a time-stamp, bid and offer prices for transactions up to $10 million. The following pairs composed in the dataset: AUD/CAD, AUD/NZD, AUD/JPY, AUD/ USD, CAD/JPY, CHF/JPY, EUR/AUD, EUR/CAD, EUR/CHF, EUR/GBP, EUR/JPY, EUR/NZD, EUR/ USD, GBP/AUD, GBP/CAD, GBP/CHF, GBP/JPY, GBP/USD, NZD/CAD, NZD/JPY, NZD/USD, USD/ CAD, USD/CHF and USD/JPY. Furthermore, for the event studies in section 6.4, where we read spread information, we use tick data from Dukascopy (Dukascopy, 2015), a company gathering bids and offers from market participants through an order book that contains time-stamp, bid and offer price, but unlike Oanda data, it also contains bid and offer quoted volume.

6.2An intrinsic network

We now present the intrinsic network used in the following subsections. Firstly, as we are concerned with high frequency market conditions we choose the first threshold δ1 to be 0.025% and taking each next threshold as the double of its predecessor. We use a total of twelve thresholds

The proposal to set the thresholds in an optimal manner can steam from Maximum Entropy Principle applied on the surprise

6.3Extreme events

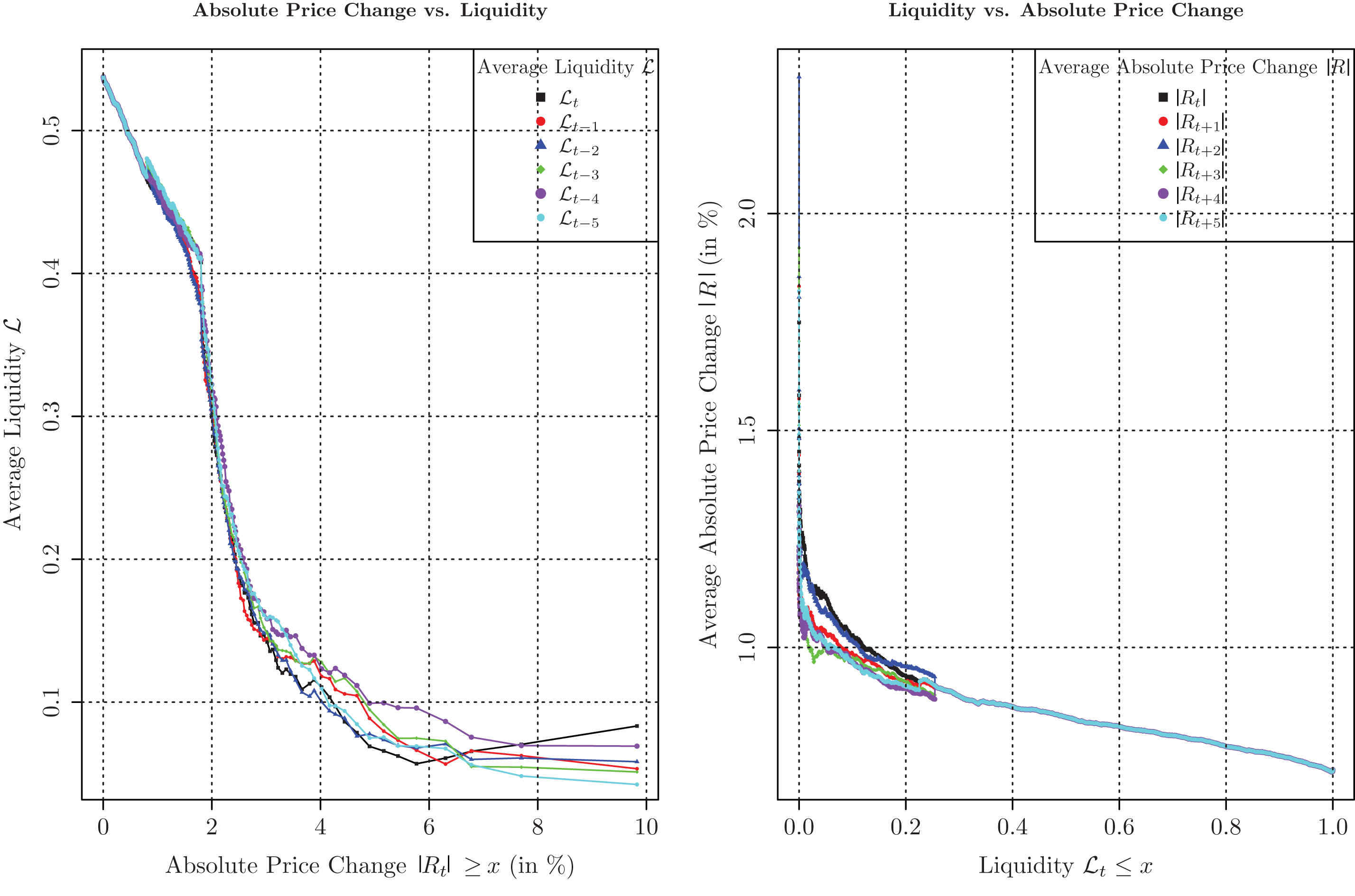

We start by systematically exploring the relationship between liquidity

For all exchange rates in our dataset, we compute the daily absolute price changes |Rt| and compare it with

(13)

(14)

Figure 4 shows the behaviour of

6.4Liquidity shocks

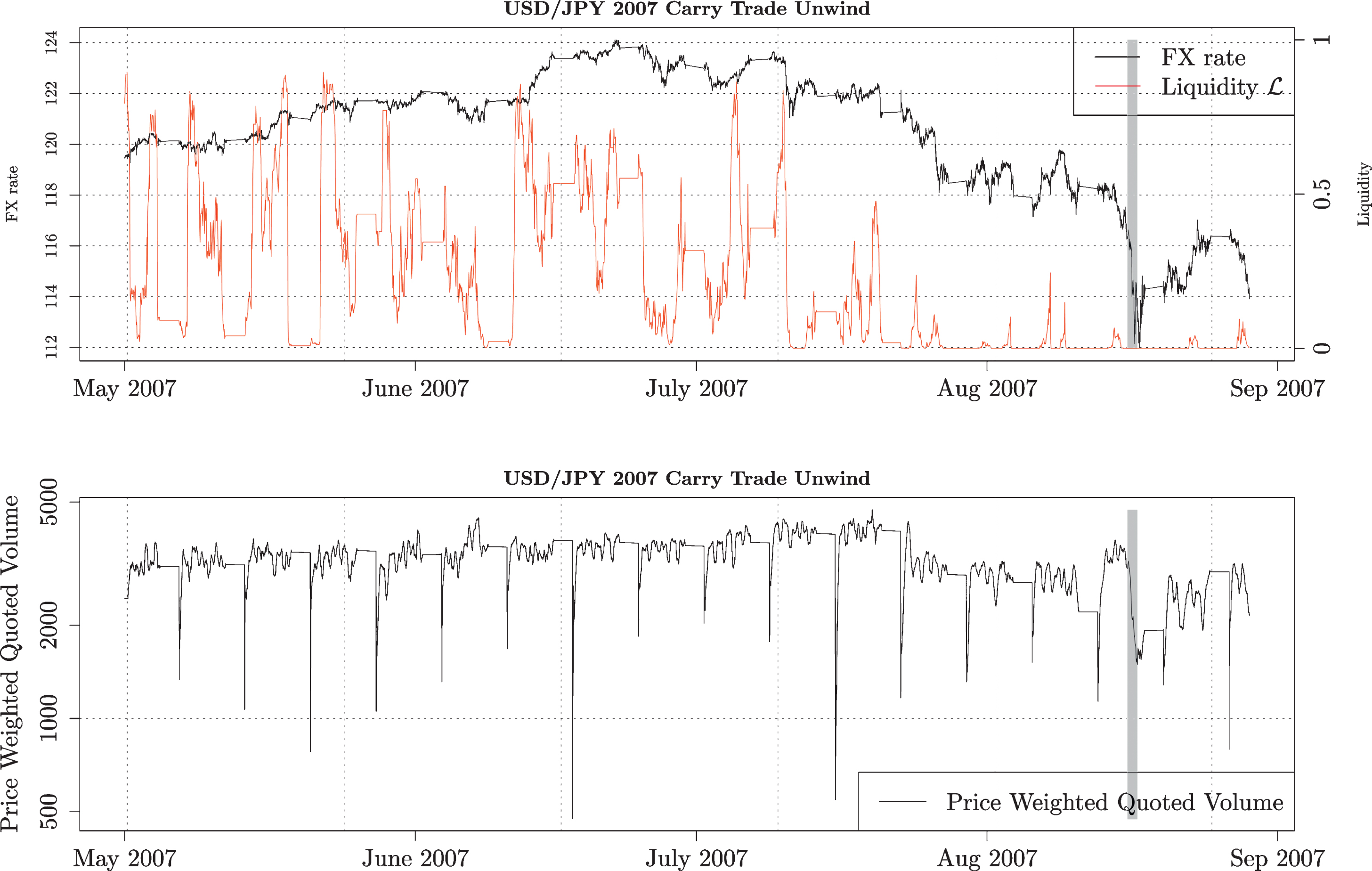

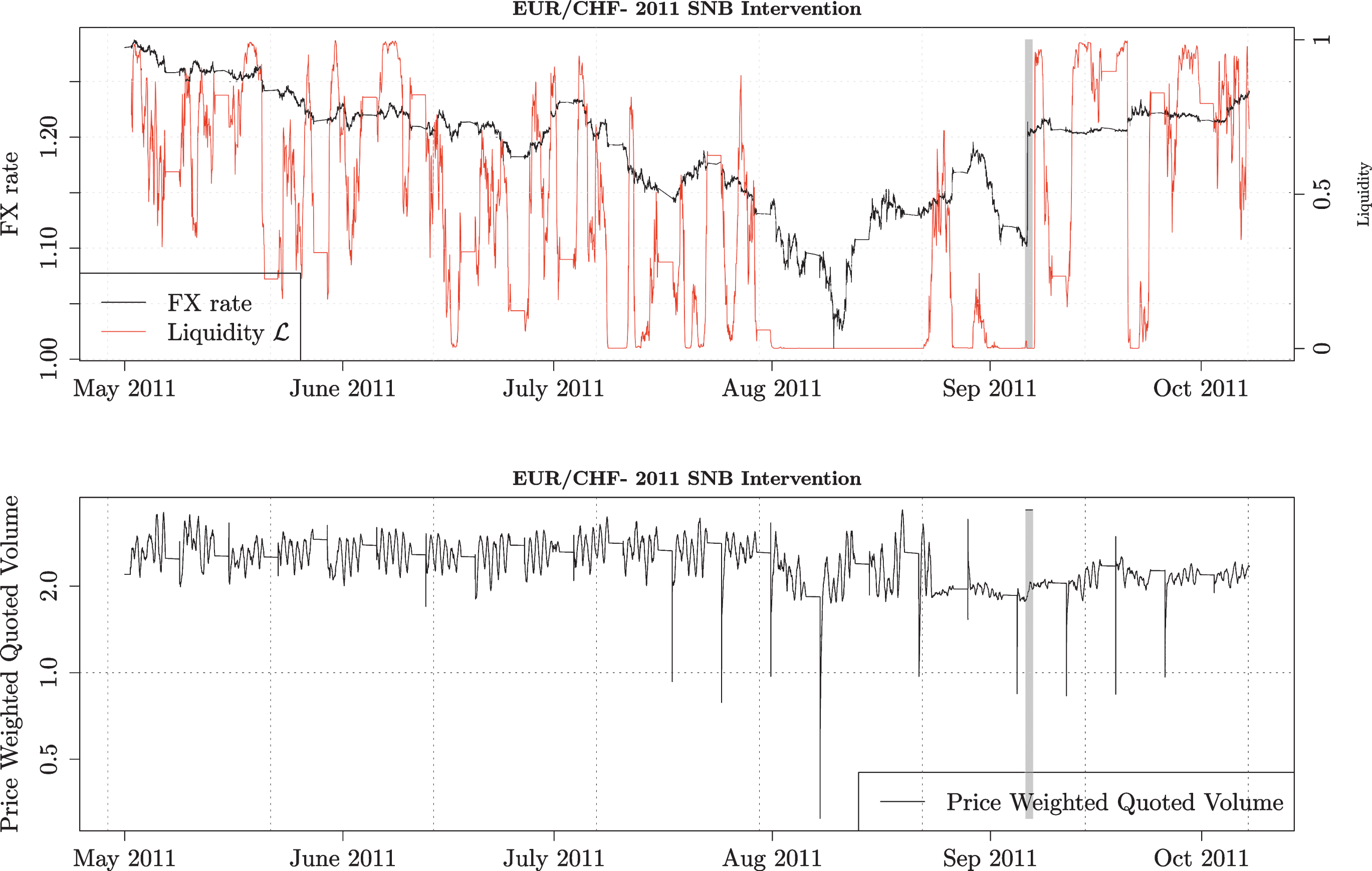

It is also instructive to examine how the measurement behaves during well-known crises. We therefore choose to focus on well documented events: August 2007 Yen carry trade collapse (Brunnermeier et al., 2008) and the Swiss National Bank implementation of 1.20 floor on EUR/CHF (Dorgan, 2012).

First we present the liquidity measurement

The upper graph in Fig. 5 shows the time evolution of the tick-by-tick USD/JPY exchange rate, as well as the evolution of the liquidity

On the other hand, to compare with alternative liquidity measurements, in the lower part of the Fig. 5 we depict the average price weighted quoted volume over the 24 hour period plotted every minute. It also shows a decrease in the price weighted quoted volume in the three weeks preceding the carry trade unwind, having its lowest value on August 16th 2007. With the delay of around 2 weeks, comparable conclusions could be drawn with the two techniques, even though

Next we focus on the Swiss National Bank (SNB) setting the floor on EUR/CHF (Schmidt, 2011). The upper graph in Fig. 6 shows the time evolution of the tick-by-tick EUR/CHF exchange rate and minute-by-minute liquidity

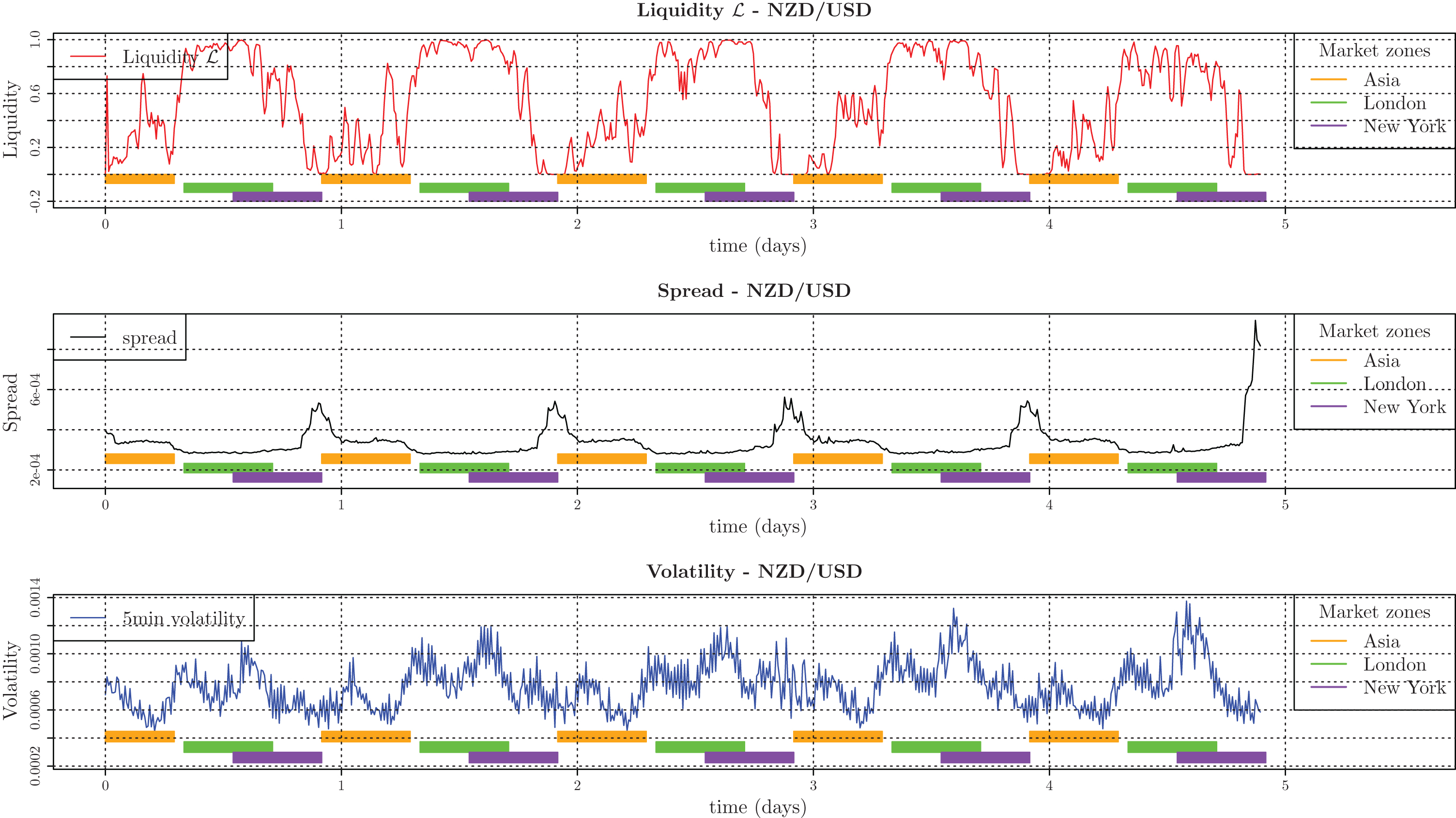

6.5Intra-week seasonality

In this subsection we present intra-week seasonality in liquidity

Figure 7 shows the intra-week (Monday to Friday) pattern of the liquidity

7Conclusion

Liquidity is often measured following top-down approaches that require one to make firm assumptions about market behaviours and often elude market micro-structures that we believe have a rich content somewhat still largely unexploited. In our point of view, a bottom-up multi-scale approach provides an alternative to describe liquidity where market micro-structures is fully embraced and where minimal assumptions have to be made.

We have indeed presented above an alternative measure where we only use the price evolution of the asset that is dissected by identifying directional changes of price. After a directional change, the price can further move to form a so-called overshoot region before exhibiting another directional change. Inspired by the idea that a long overshoot might be the signature of a lack of liquidity we propose a new measure of liquidity by mapping the price trajectory onto a multi-scale Markov chain framework termed intrinsic network. We compute the transition probabilities of the network for a benchmark Brownian motion that allows us to define illiquidity by quantifying unlikeliness of price trajectories.

The new measure is applied to empirical FX data where we systematically analyse market events to observe that low liquidity is indeed correlated to large price moves. We then concentrate our attention on a couple of well-known liquidity shocks and observe the way our measure shows low liquidity during, but also before, these episodes. These empirical analyses therefore not only show the success of our approach but also tend to indicate that it has a potential to be an early warning indicator, highly appreciated to possibly announce forthcoming crises.

Funding

The research leading to these results has received funding from the European Union Seventh Framework Programme (FP7/2007-2013) under grant agreement no 317534.

Notes

1 A scaling law establishes a mathematical relationship between two variables that holds true over multiple orders of magnitude.

Appendices

A. The analytical Gaussian benchmark

In the special case where the price follows a Brownian motion, the transition matrix can be derived analytically. Since the hierarchical nature of the intrinsic network allows deducing the transition matrix for any number of thresholds by a contracting process, the problem actually boils down to solving the two-thresholds case, which we do now. In case the transitions on the intrinsic network are modelled as first order Markov Chain, the matrix has the following form

(15)

Let us now focus on the situation where the system just turned to the (1, 0) state. As we can read it from W, it was previously in (0, 0) and just bounced back from some minimum by an amount δ1. Two events may occur now

• either the upward move goes further by an amount δ2 - δ1 and the system turns to the (1, 1) state,

• either after having reached some maximum M < δ2 - δ1 the walk goes downward by an amount δ1 and the system turns back to (0, 0).

The question is therefore to determine the probability of each of these two scenarios to occur. This is somewhat reminiscent of the famous gambler’s ruin, but the situation is more involved here due to the presence of two absorbing barriers, one of which is moving in time.

Let us denote A ≡ x0 + Δ the upper fixed barrier and B ≡ M - δ the moving lower one (for the sake of notation we put Δ ≡ δ2 - δ1 and δ ≡ δ1). We now dissect the interval (x0, A) in small intervals (x0, x0 + ε), (x0 + ε, x0 + 2ε),..., (A - ε, A) with ε ≡ Δ/n for some n. In order for the walk to reach A before B, it has, as a very first step, to reach reach x0 + ε before x0 - δ and then to reach x0 + 2ε before x0 + ε - δ, and so on. We are thus led to rewrite the probability (let us denote it

(16)

But then invariance properties (Markovianity and translation invariance) of Brownian motion allow us to simplify this expression as

(17)

Let us now simplify a bit further the notation and assume we have a Brownian motion with mean μ and variance σ2 starting at a position x0 somewhere between two absorbing barriers U (upper) and L (lower). The probability density of finding the walk at position x at time t will obey the backward diffusion equation

(18)

(19)

(20)

(21)

We then split the total probability of absorption as g- (x0, t) + g+ (x0, t), where g± (x0, t) denotes the probability of absorption by the upper, respectively lower, barrier. The transform is split accordingly as G- (x0, s) + G+ (x0, s) with boundary conditions G+ (U, s) = G- (L, s) =1 and G+ (L, s) = G- (U, s) =0. Equation (21) can thus be solved separately for G+ and G-. We use the standard ansatz G± = exp(θx0) which boils down the differential equation to a quadratic algebraic equation for θ easily solved to yield

(22)

(23)

(24)

This quantity is therefore the probability to get caught by the upper barrier without having ever met the lower one, which is P (x0 + ε ∖ x0 - δ) we introduced at the beginning. It thus remains to calculate

(25)

(26)

This expression happens to simplify in the driftless case to the harmless formula

(27)

(28)

The derivation established that the probability of overshoot ω (δ1 ; σ) reaching the length δ2 - δ1 equals

(29)

B. Implicit hierarchy

Here we demonstrate that intrinsic networks have a convenient multi-scale property where one can dismiss the smallest threshold from the framework and still preserve the structure. In order words, if we remove the directional change threshold δ1 of an n-dimensional intrinsic network

Firstly, we introduce the concept of islands which are subsets of all possible states

(30)

Let us extend the concept of state contraction by defining islands of level 0,

(31)

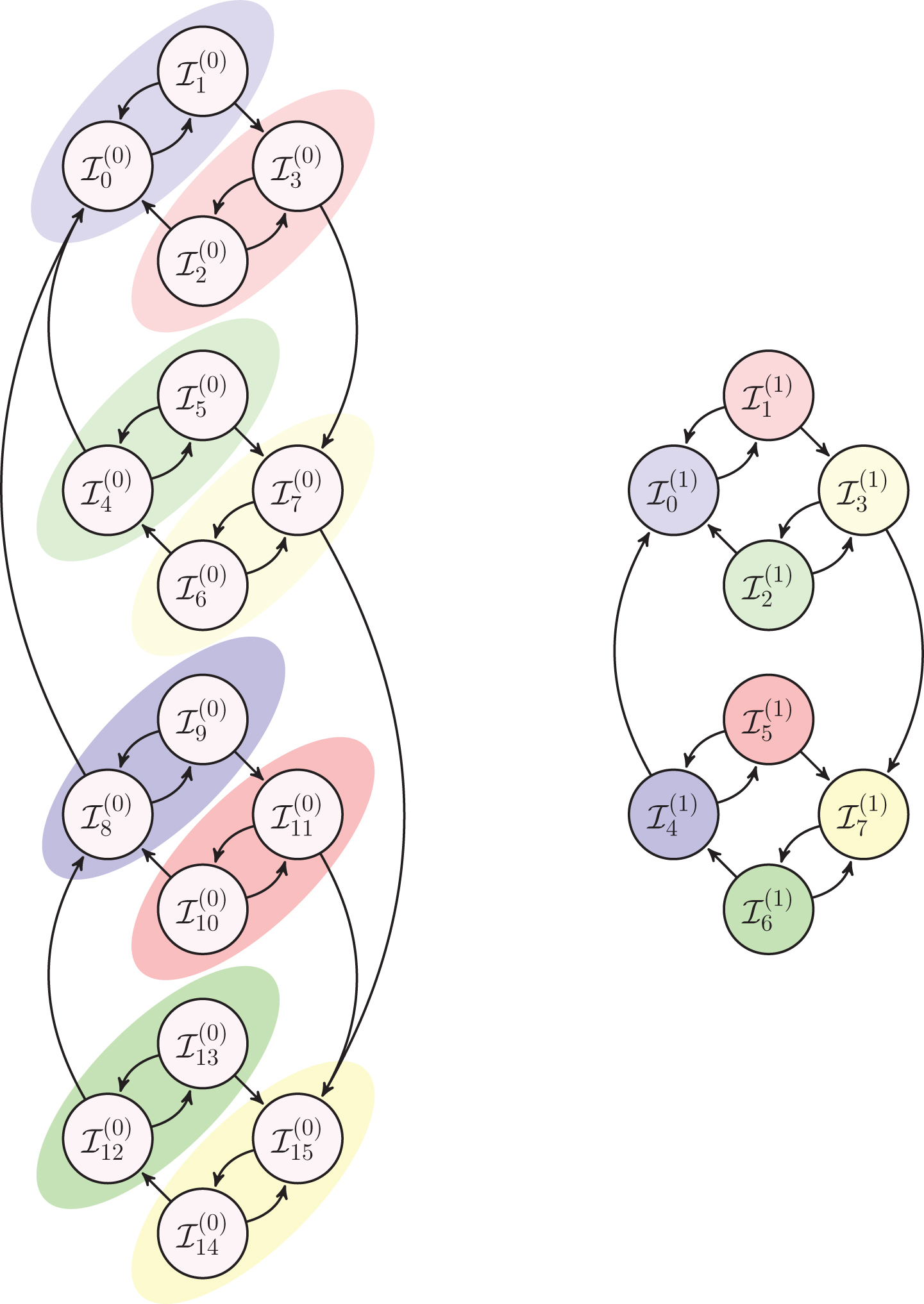

Figure 8 illustrates the process of state contraction, of 4-dimensional intrinsic network

Assuming the transitions on the intrinsic network are modelled as a first order Markov chain, there is an explicit connection between the transition matrix W of the n-dimensional intrinsic network and transition matrix

Let us assume that the current state of the network is

for mod (k + j, 2) = 0

(32)

(33)

(34)

C. State contraction probabilities

We demonstrate that assuming the transitions on the intrinsic network are modelled as a first order Markov Chain, there is an explicit connection between the transition matrix W of the n-dimensional intrinsic network and transition matrix

Let us assume that the current state of the network is

(35)

(36)

(37)

(38)

(39)

(40)

D. Transition probability derivation

We demonstrate the derivation of the analytic expressions of transition probabilities presented in Section 5. Firstly, we prove the claim holds for 3-dimensional intrinsic network, let δ1 < δ2 < δ3 denote the ordered directional change thresholds,

(41)

(42)

(43)

References

1 | Bank of International Settlement. Triennial central bank survey foreign exchange turnover in april 2013, (2013) . Monetary and Economic Department. |

2 | Bauwens L., Hautsch N., (2009) . Modelling financial high frequency data using point processes. In Anderson T.G. and et al., editors, Handbook of financial time series, Springer, Berlin, pp. 953–976. |

3 | Brunnermeier K.M., (2009) . Deciphering the liquidity and credit crunch 2007–2008. Journal of Economic Perspectives 23: (1), 77–100. |

4 | Brunnermeier M.K., Nagel S., Pedersen L.H., (2008) . Carry trade and currency crashes, National Bureau of Economic Research Working Paper. |

5 | Chaboud A., Chiquoine B., Hjalmarsson E., Vega C., (2014) . Rise of the machines: Algorithmic trading in the foreign exchange market, (Forthcoming) Journal of Finance. |

6 | Clark P.K., (1973) . A subordinated stochastic process model with finite variance for speculative prices. Econometrica 41: , 125–156. |

7 | Cover T., Thomas J., (1991) . Elements of information theory. John Wiley & Sons, New York, NY, USA. |

8 | Dacorogna M.M., Gencay R., Müller U.A., Olsen R.B., Picet O.V., (2001) . An introduction to high-frequency finance. Academic Press, San Diego (CA). |

9 | Di Matteo T., Aste T., Dacorogna M.M., (2005) . Long term memories of developed and emerging markets: using the scaling analysis to characterize their stage of development. Journal of Banking and Finance 4: (4), 827–851. |

10 | Dorgan G. Snb losses 1.85 billion francs in just one day, 231 francs per inhabitant, 2012. SNBCHF.com. |

11 | Dukascopy., 2015. www.dukascopy, [Online; accessed 21-April-2015]. |

12 | Fernandez F.A., (1999) . Liquidity risk, SIA Working Paper. |

13 | Gabrielsen A., Marzo M., Zagaglia P., (2011) . Measuring market liquidity: an introductory survey, MPRA Paper 35829, University Library of Munich. |

14 | Galluccio S., Caldarelli G., Marsili M., Zhang Y.C., (1997) . Scaling in currency exchange. Physica A 245: , 423–436. |

15 | Glattfelder J.B., Dupuis A., Olsen R.B., (2011) a. Patterns in high-frequency fx data: Discovery of 12 empirical scaling laws. Quantitative Finance 11: (4), 599–614. |

16 | Glattfelder J.B., Dupuis A., Olsen R.B., (2011) b. Patterns in high-frequency fx data: discovery of 12 empirical scaling laws. Quantitative Finance 11: (4), 599–614. doi: 10.1080/14697688.2010.481632. URL http://dx.doi.org/10.1080/14697688.2010.481632 |

17 | Golub A., Chliamovitch G., Dupuis A., Chopard B., (2015) . Uncovering discrete nonlinear dependence with information theory. Entropy 17: (5), 2606. ISSN 1099-4300. doi: 10.3390/e17052606. URL http://www.mdpi.com/1099-4300/17/5/2606 |

18 | Guillaume D.M., Pictet O.V.M., Müller U.A., Dacorogna M.M., (1995) . Unveiling non-linearities through time scale transformations, Olsen Working Paper. |

19 | Guillaume D.M., Dacorogna M.M., Dave R.R., Muller U.A., Olsen R.B., Pictet O.V., (1997) . From a bird’s eye to the microscope: A survey of new stylized facts of the intra-day foreign exchange markets. Finance and Stochastics 1: , 95–129. |

20 | Ito T., Hashimoto Y., (2006) . Intra-day seasonality in activities of the foreign exchange markets: Evidence from the electronic broking system. National Bureau of Economic Research Working Paper No. 12413. |

21 | Kavajecz K.A., Odders-White E.R., (2004) . Technical analysis and liquidity provision. The Review of Financial Studies 17: (4), 1043–1071. |

22 | LeBaron B., (1994) . Chaos and nonlinear forecastability in economics and nance. Philosophical Transactions: Physical Sciences and Engineering 348: (1688), 397–404. ISSN 09628428. URL http://www.jstor.org/stable/54216 |

23 | Mandelbrot B.B., (1963) . The variaton of certain speculative prices. The Journal of Business 36: , 394–419. |

24 | Mandelbrot B.B., Taylor H.W., (1967) . On the distribution of stock price differences. Operations Research 15: , 1057–1062. |

25 | Müller U.A., Dacorogna M.M., Olsen R.B., Pictet O.V., Schwarz M.M., Morgenegg C., (1990) . Statistical study of foreign exchange rates, empirical evidence of a price change scaling law and intraday analysis. Journal of Banking and Finance 14: , 1189–1208. |

26 | Oanda. (2015) . www.oanda.com. “[Online; accessed 21-April-2015]”. |

27 | Pfister H.D., Soriaga J.B., Siegel P.H., (2001) . On the achievable information rates of finite state isi channels. In Kurlander D., Brown M. and Rao R., editors, Proc IEEE Globecom, ACMPress, pp. 41–50. |

28 | Poon S.-H., Granger C.W., (2003) . Forecasting volatility in nancial markets: A review. Journal of Economic Literature 41(2), 478–539. doi: 10.1257/002205103765762743. URL http://www.aeaweb.org/articles.php?doi=10.1257/002205103765762743 |

29 | Sarr A., Lybek T., (2002) . Measuring liquidity in financial market, IMF Working Paper No. 02/232. |

30 | Schmidt A., (2011) . Ecology of the modern institutional spot fx: The ebs market in 2011. Technical report, Electronic Broking Service. |

31 | von WyssR., (2004) . Measuring and Predicting Liquidity in the Stock Market. PhD thesis. |

Figures and Tables

Fig.1

Price evolution example over a week-end. Directional change events (squares) act as natural dissection points, decomposing a total-price move between two extremal price levels (bullets) into so-called directional-change (solid lines) and overshoot (dashed lines) sections. Time scales depict physical time ticking evenly across different price curve activity regimes, whereas intrinsic time triggers only at directional change events, independent of the notion of physical time. The time period where the exchange rate does not change corresponds to the weekend.

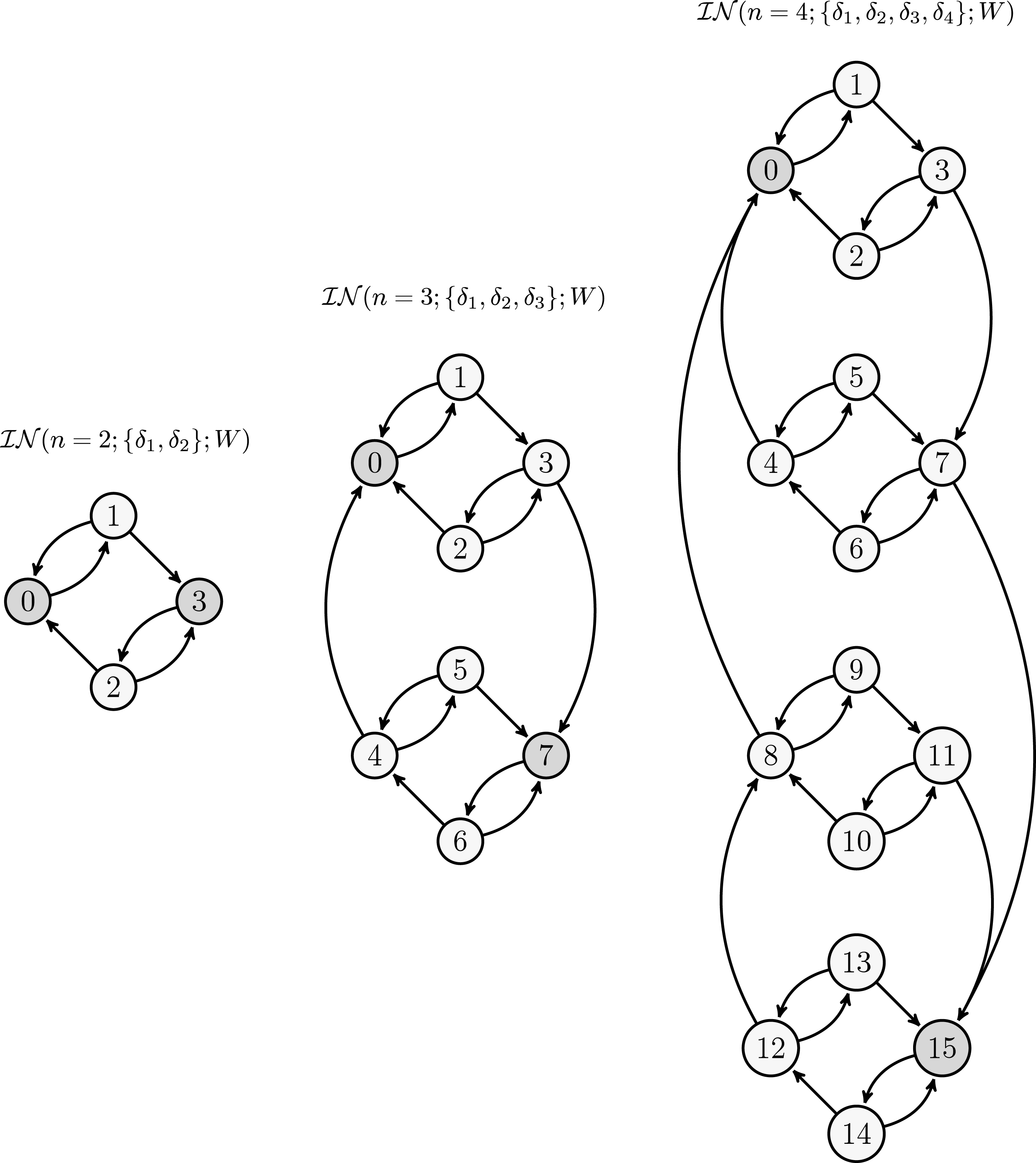

Fig.2

From left to right: 2-, 3- and 4-dimensional intrinsic networks

Fig.3

Example of transitions on 2-dimensional intrinsic network for a time series. Transitions are coloured and depicted on the graph.

Fig.4

The left graph shows the relationship between absolute daily price changes larger than x and average liquidity

Fig.5

The upper graph shows tick-by-tick USD/JPY

exchange rate (left axis) and

the corresponding one minute liquidity measurement

Fig.6

The upper graph shows tick-by-tick EUR/CHF exchange rate (left axis) and

the corresponding one minute liquidity

Fig.7

The graph shows intra-week seasonality pattern for liquidity

Fig.8

Illustration of the contraction procedure of a 4-dimensional

intrinsic network