An experimental measure of Malaysia’s gig workers using labour force survey1

Abstract

With the increase in the labour supply and the labour market imbalances globally, a notable increase is witnessed in the number of temporary employments as well as flexible arrangement in employment. This new development coupled with technological advancement create opportunity for flexible work through digital platforms, and the emergence of a new term in employment – the “gig” employment. Examples of gig workers are ‘independent contractors’, ‘consultants’, or ‘contract professor’, which are working only to complete a task for specific time and specific payment, with no work connection with their hiring institution once the contract ends. In the meantime, digitalisation has created more opportunities for individuals to engage in gig employment for income generation. The rise of the gig workers calls for new initiatives in human resource development policy as they continue to play important roles in employment creation, production and income generation. From this study, a total of 218 occupations were identified as gig works which offered flexible working hours, flexible workplace and with or without digital presence. This study attempts to measure the gig workers in Malaysia using Labour Force Survey to gauge sociodemographic profiles of this new group of employment.

1.Introduction

The advances in technology over the years has brought fundamental changes in the way we work and the types of locations in which we work. Standard employment contracts and engagement with employers have changed dramatically, partly due to the long-term trends of non-standard work arrangements, and the boost of the platform economy or gig economy which has become a major game-changer. Due to the increased demand for flexibility, changing in work arrangement supported by the advancement in technology created a new environment of economy called “gig” economy. This is in accordance with the findings from Countouris where workers are more involve in non-standard employment, including temporary employment; temporary agency work and other multi-parties work, indefinite employment relationships and part-time employment [1]. Countouris also found that these arrangements can provide businesses and workers with important flexibility, yet often associated with lower earnings, reduced social security coverage and diminished working conditions [1].

Persons in employment are defined as all persons above a specified age who during an identified brief period, either one week or one day, were in the paid employment or self-employment categories [2]. During the 20

In line with the type of authority exercised by workers, working hours for employees are usually determined by the employers whereby employees do their assigned tasks as required by the employers. Consequently, employees are remunerated in the form of wages & salaries, paid leave and other forms of social benefits. Usually, employers or companies provide labour protections as a part of the contract to their employees. Own account workers or the broader category of self-employed are individuals who run their own business. Generally, this type of employment offers flexible working hours and a flexible workplace. However, as this group work for profits rather than for pay, there usually lack social safety nets.

In the country, the Malaysia Digital Economy Corporation (MDEC) is ready and fully focused on leading Malaysia’s Digital Economy forward by accelerating (i) formulation of policies and coordination of agencies to enable success; (ii) development of future proof workforce to grow the digital economy ecosystem; and (iii) creation of global champions to increase contribution from the digital economy to gross domestic product. However, the information available in the administrative record is limited to registered formal establishments that operate only on digital platform. Thus, there is a possibility of under-representation of self-employed workers who are operating informally within the digital platform. In addition, those who worked flexible hours at no specific locations without the presence of a digital platform such as door to door sales persons, beauticians and journalists are also categorised as gig workers.

The recent widespread of COVID-19 pandemic and the subsequent action by the Malaysian government to curb it through phases of Movement Control Order resulted employees in selected industries to experience pay cuts and job losses. Due to the pandemic, people who lost their jobs have taken alternatives to gain income by working as food rider or runner. This group of workers whom drive and tend motorcycles, motorised tricycles, cars or vans to transport passengers, materials or goods is also categorised as gig workers. The pandemic contributing to the rise of gig workers called for new initiatives in human resource development policy as they continue to play important roles in employment creation, production and income generation. These recent developments coupled with technological advancements create opportunity for flexible working arrangements and employment. Thus, the objective of this paper is to identify gig employment and its characteristics and thereby attempt an experimental measure of this group in Malaysia using the Labour Force Survey (LFS).

2.Literature review

Gig economy can be described as economic activity related to short-term, project-based and outcome-defined work. Donovan, Bradley & Shimabukuru stated that the gig economy is the collection of markets that match providers to consumers on a gig (or job) in support of on-demand commerce [4]. According to Abraham et al., the term gig economy refers to work obtained through an online platform with work doled out in bits and pieces [5]. In Ireland and United Kingdom, gig economy generally refers to app-based services done on demand and on location. International Labour Organisation (ILO) noted that forms of work in the gig economy include “crowdwork” which referred to working activities that imply completing a series of tasks through online platforms, and “work-on-demand via apps” channeled through apps managed by firms [6].

Workers in gig economy are commonly known as gig worker. However, more recently, the term “gig work” has become associated with or representative of alternative, less structured work arrangements specifically focus on non-employees with or without digital presence. Examples of gig workers are “independent contractors”, “consultants”, or “contract professor”, who work only to complete a particular task for specific time and specific payment, with no more connection with their employer once the contract ends. Abraham et al. defined gig workers as a worker that has no wage or salary, unclear contracts of agreement for continuing relationship, has no fixed schedule and unpredictable income. This include independent contractors, freelancers, day labourers and on-demand workers [5].

Bernard Marr, described gig as people that work independently for multiple companies [7]. According to Bernard Marr, Marion McGovern, the author of Thriving in the Gig Economy, defined gig as an independent worker and believed it has been practiced for a long time. M Squared Consulting Company founded by McGovern in 1988 were responsible in matching the independent consultants to suitable projects. Thus, McGovern does not agree with the narrow definition of gig as a job secured through digital platform. Hence, the possible reason why the term “gig work” has become popular and emerges as an important concept in the current market is the revolution in technology [7]. This include variation of devices such as laptops and smartphones; improved internet access; trending social media platforms; and cloud technology which altogether help to enhance the on-demand job that can be created through the gig concept.

Within the global landscape, there exists a gap in which this phenomenon cannot be conceptually defined and statistically measured uniformly, and hence, comparable measure across countries remains a challenge. According to the ILO, gig workers often work independently, in isolation, over geographically expansive areas, and in direct competition with one another [8]. Therefore, they are often classified as independent contractors. Gig work is often short-term or task-based; with higher presence in online labour platforms [8]. Statistics Canada stated that gig workers are usually not employed on a long-term basis by a single firm; instead, they enter into various contracts with firms or individuals (task requesters) to complete a specific task or to work for a specific period of time for which they are paid a negotiated sum [9]. Meanwhile, the Bureau of Labour Statistics (BLS) of the United States of America defined gig workers as those who do not have an implicit or explicit contract for long-term employment. They include independent contractors (also called freelancers or independent consultants), on-call workers, and workers provided by temporary help agencies or contract firms [10].

3.Methodology

This study aims to identify gig workers in Malaysia. Ideally, gig workers ought to be defined as employed persons who worked on flexible hours, flexible workplace, with or without digital presence with status as independent workers, freelancers or part-time employees. Currently, no survey focuses on gig workers and implementing new surveys are time consuming and is a long-term solution in measuring gig workers. However, it may be possible to develop some measurement on self-employment as proxies for gig workers while recognising its limitations. Laß and Wooden stated that the variable of main job in Household Labour Force Survey (HLFS) in Australia could be used for an analysis of non-standard work using categories for employees and self-employed [11]. However, Riggs. L, Sin. L and Hyslop. D believed that these measures may be too broad to adequately distinguish gig work from other works [12]. According to Laß and Wooden, non-standard employment in Australia covered self-employed workers, contributing family workers, fixed-term employees, casual employees, other employees, and permanent part-time employees [11].

This study used 2018 LFS data since there is no specific study conducted to measure gig employment. Own-account workers and part-time employees from LFS were considered for identifying gig workers in Malaysia. Hours worked was considered such that gig employment can be either full-time or part-time employment. LFS is regularly conducted by the Department of Statistics Malaysia (DOSM) on a monthly basis to collect demographic information on all household members and labour force particulars of household members aged 15 years and above. Information on the structure and distribution of the labour supply encompassing labour force, employment, unemployment and outside labour force are determined in this survey. LFS adopts a stratified two stage sampling design. The first stage unit of sample selection is the enumeration blocks (EBs) consisting of 80 to 120 living quarters (LQs), while the second stage unit is the selection of LQs within the EBs. All persons in the selected LQs are canvassed. The latest detailed methods of the LFS are available in the LFS Report [13]. The sample units are systematically drawn with equal probability of being selected at every stage of selection. The response rates of the annual LFS are usually more than 85 per cent for all the years involved.

The Malaysia’s LFS defines employed persons as those who at any time during the reference week worked at least one hour for pay, profit or family gain. They are also considered employed if they did not work during the reference week because of illness, disability, on leave but had work to return to, were temporary laid-off with pay and would definitely be back to work. Employed persons include those who are either fully employed or time-related underemployed who are seeking to work more hours. Those in full employment refers to persons who were employed more than 30 hours during the reference week while time-related underemployment were persons who employed less than 30 hours during the reference week because of the nature of their work or insufficient work and able to accept additional hours’ work.

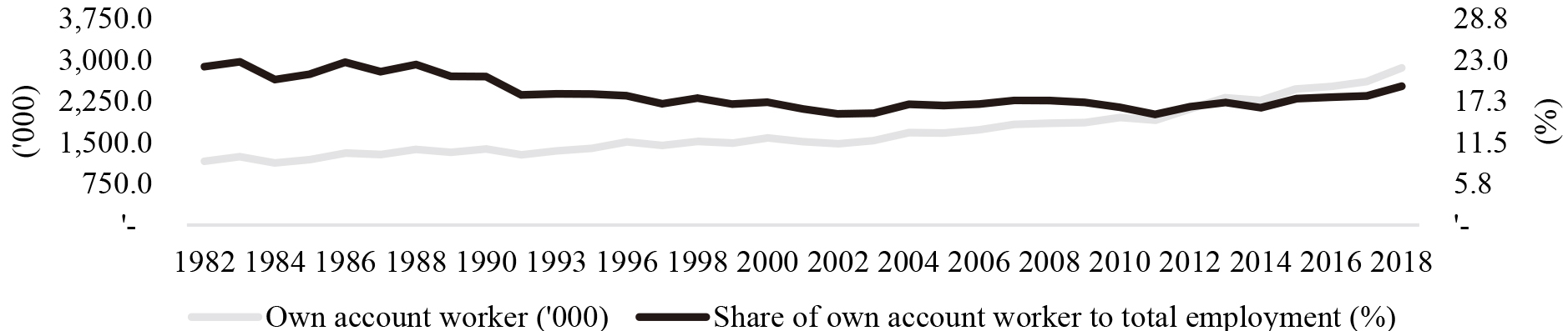

Figure 1.

Number of own account workers and percentage share of own account worker to total employment, Malaysia, 1982–2018. Source: Labour Force Survey Time Series, Department of Statistics Malaysia (DOSM).

The industry classifications in LFS were according to the Malaysia Standard Industrial Classification (MSIC) 2008 version 1.0 which was aligned with the International Standard Industrial Classification of All Economic Activities (ISIC) Revision 4. In the same context, a person’s industry classification was based on the industry of his/her principal occupation. Meanwhile, occupations were classified according to the Malaysian Standard Classification of Occupation (MASCO) 2013 which was based on International Standard Classification of Occupation (ISCO) 2008 with improvements to incorporate transformation of work process and areas of specialisation as well as the complexity and dynamics in skills and tasks.

To provide a comprehensive socioeconomic characteristic of the labour supply, the LFS also measures status in employment. However, at present, the measure is based on ICSE-93, with adaption to national circumstances encompassing employers, paid employees, own account workers and unpaid family workers. DOSM defined an own-account worker as a person who operates his/her own farm, business or trade without employing any paid workers in the conduct of his/her farm, trade or business [13]. According to Fig. 1, the share of own-account workers to total employment showed increasing trend from 2011 until 2018, albeit a slight decrease was recorded in 2014. With the development of technology and young people mostly preferring a flexible working time and flexible workspace, the rise of own account workers is undeniable. The annual LFS from 1982 to 2018 were used to illustrate trends and developments in employment. Nevertheless, the identification of characteristics of gig workers and the subsequent profiling were based only on the 2018 LFS data.

In defining gig workers for Malaysia, this paper focused on employed persons in primary jobs with respect to three variables namely: status in employment, hours worked, and occupation. In terms of status in employment, employees and own account workers were identified. From the total number of employees, those who worked less than 30 hours per week were identified and used as a proxy for part-time employees. Meanwhile, among own account workers, gig workers are identified regardless of the hours worked. Occupation category which was considered freelancers such as tutor, tuition teacher, photographer, videographer and tourist guide, were accounted in this study. Technology-based occupations such as web designer, software developer, driver (Grab, MyCar etc.) and rider (Grabfood, Foodpanda etc.) were also considered as gig workers. Considering the various ways of defining and obtaining identity for gig workers, a total of 218 unique 6-digit occupations title were identified as gig-related occupations in the LFS 2018 data set. Appendix 1 provides the complete list of gig-related occupation used for the study. After the selected occupations are considered, industry that belong to the gig worker are reviewed to get know which industries are heavily dominated by gig workers.

Gig workers are spread over various occupations and industries groups. This made it difficult to identify them in a survey. Thus, the resulting estimate of number of gig workers in Malaysia derived from the LFS in the present study are not exactly accurate. However, identifications based on the status in employment; hours worked; and occupations, whether freelancers or technology-based, provided close approximations on the number of gig workers according to its proposed definition for Malaysia.

4.Results

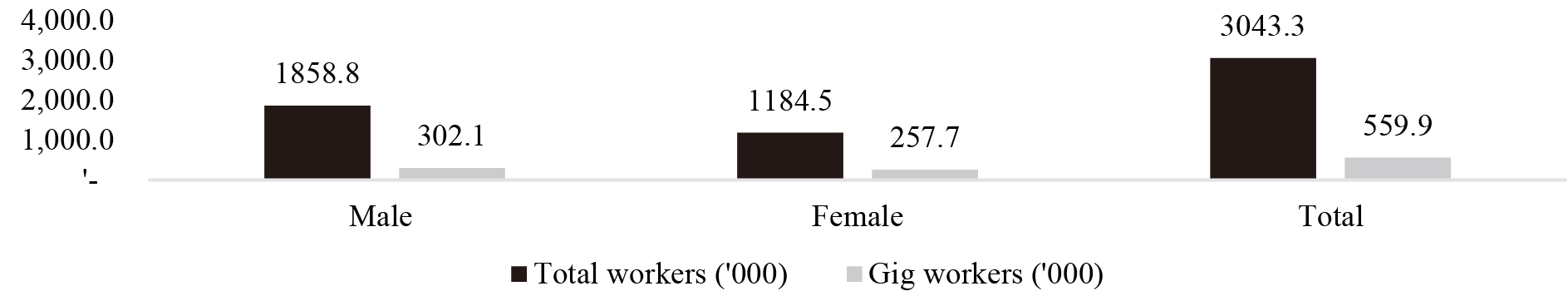

In 2018, it was estimated that 3,043.3 thousand persons were employed as part-time private employees and own account workers in Malaysia as in Fig. 2. Gig workers made up 18.4 percent of this, or about 559.9 thousand persons. Breakdown of gig workers by sex showed that more than half of the gig workers were male with share of 54.0 percent (302.1 thousand persons) as against female share of 46.0 percent (257.7 persons). It should be noted however, that the said share of female gig workers to total gig workers was higher than the 38.9 per cent share of female to total workers in Malaysia.

Table 1

Number of gig workers and percentage share by economic activities, Malaysia, 2018

| Economic activities | Total (’000) | Percentage share (%) |

|---|---|---|

| Agriculture | 1.0 | 0.2 |

| Industry | 15.9 | 2.8 |

| Services | 543.1 | 97.0 |

| Wholesale and retail trade | 206.0 | 36.8 |

| Transportation and storage | 90.9 | 16.2 |

| Accommodation and food service activities | 10.0 | 1.8 |

| Other services | 236.1 | 42.2 |

| Total | 559.9 | 100.0 |

Source: Authors’ estimates based on 2018 Labour Force Survey data, (DOSM).

Figure 2.

Number of total workers and gig workers by sex, Malaysia, 2018. Source: Authors’ estimates based on 2018 Labour Force Survey data, (DOSM).

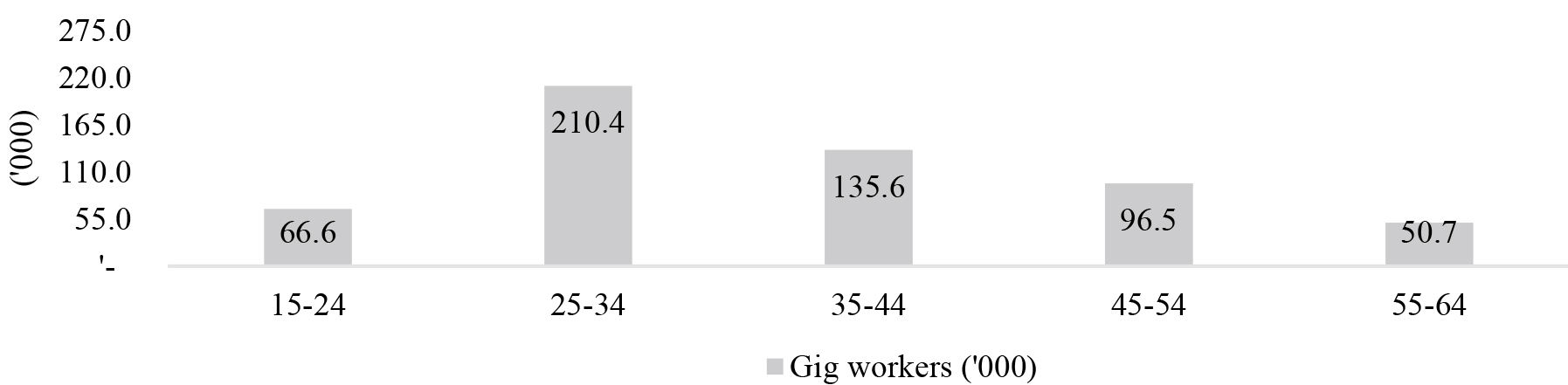

Figure 3.

Number and share of gig workers by age group, Malaysia, 2018. Source: Authors’ estimates based on 2018 Labour Force Survey data, (DOSM).

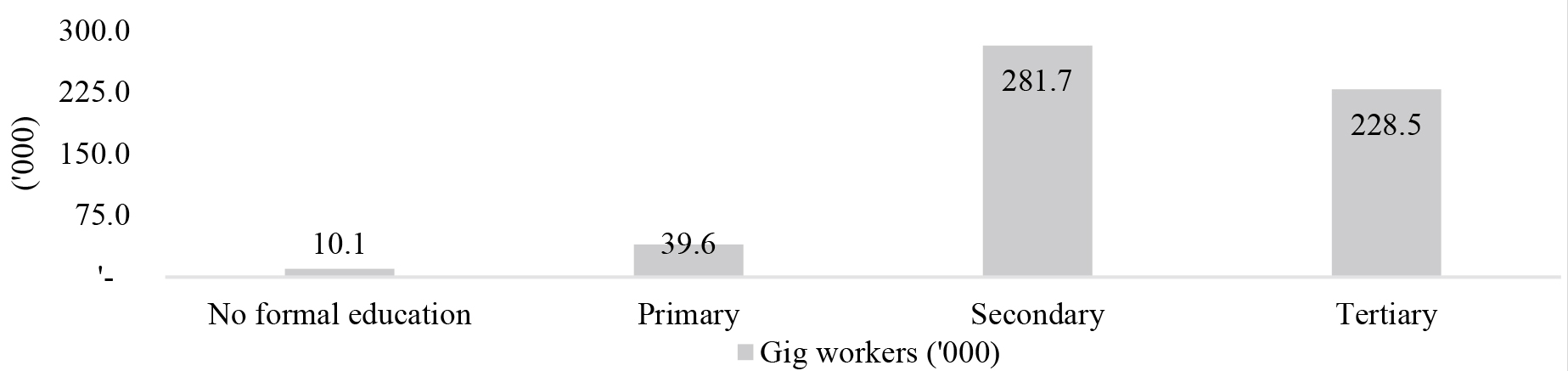

Figure 4.

Number and share of gig workers (‘000) by education attainment, Malaysia, 2018. Source: Authors’ estimates based on 2018 Labour Force Survey data, (DOSM).

Among age group, the highest share of gig employment of 37.6 per cent was recorded in the 25 to 34 years’ age group followed by the 35 to 44 years with a share of 24.2 per cent. Meanwhile, the lowest share in gig employment of 9.1 per cent was posted by the 55 to 64 years’ age group (Fig. 3). This pattern is consistent with the overall distribution of employed persons with the peak also observed among the 25 to 34 years’ age cohort.

In terms of educational attainment, more than half (281.7 thousand persons) of the gig workers attained secondary education. Interestingly, 40.8 per cent of gig workers has tertiary education, recorded 228.5 thousand workers as illustrated in Fig 4. It should be noted that the distribution pattern for gig workers in terms of education attainment, were observed when looking at total employment in Malaysia.

Based on Table 1, gig workers were divided into three main sectors: agriculture, industry and services. Services sector recorded the highest share of gig workers which accounted for 97.0 percent with majority of gig workers employed in wholesale and retail trade activities and transportation and storage activities with 36.8 percent and 16.2 per cent share to total number of gig workers, respectively.

5.Discussion

The experimental measure of gig workers indicated that the distribution of gig workers is similar to the total employment. Nevertheless, some interesting findings showed inclination of one gender over the other, age distribution as well as education background of gig workers. Results signaled that women tend to join the labour market as gig employment especially for those who have family responsibility such as taking care of children as it offers flexible working arrangements as illustrated in Fig. 2. Besides, development of digital retail platform also creates pathway for women’s involvement in gig economy. Generally, stay at home wives and mothers prefer to do online business as they can work from home via laptop or mobile phone while taking care of other responsibilities.

From the viewpoint of age (Fig. 3), those aged 25 to 34 years were prevalent as gig workers since most of them were most likely to have had just completed schooling. This might be due to the flexibility of this form of work which allow them to also allocate time to seek for something more permanent, as well as a base for exploring something that could be profit-oriented in the long term. The low share of gig workers aged 55 to 64 could mean that the gig employment could be just a means to gain extra income to ensure a comfortable retirement plan.

People with secondary education usually earn lower pay than those who have tertiary education (Fig. 4). In order to get an extra income, most of them prefer to join gig employment as full-time or part-time workers. For people with tertiary education, some of them have difficulties in getting a job with satisfying salaries and benefits. Some of them also cannot find a job after finishing their studies. Hence, gig employment offers an alternative way for them to supplement their financial with jobs that offer flexible working arrangement.

Wholesale and retail trade as well transportation and storage activities in gig employment are incredibly popular right now especially with the growth of technology (Table 1). The rise of various online selling websites is very popular among women. Platform such as Grab and MyCar make it convenient for the customers to book a drive only through online application. Some people prefer to do this type of job as a second job in order to supplement their income. Nowadays, these services are in high demand especially for those who do not own transport and also are not willing to face the heavy traffic.

6.Conclusion

The source of estimating gig workers in this study is the LFS. Gig workers were identified among the part-time employees and own account workers with occupations category which offers flexible hours, flexible workplace, with or without digital presence. Likewise, it was found that gig workers were scattered among the diverse occupation groups and were not easily identified in surveys. Another difficulty in identifying gig workers is the differences in the nature of work across occupations. Although the estimation was not perfect, the criteria for identifying gig workers based on the definitions were set.

Apart from the usage of online platforms, there are many components to consider in measuring gig economy. From this study, some improvements and way forward are identified. A supplementary survey to LFS can be created in which terms of independent contractor, independent consultant, and freelance worker are used. Questions related to work arrangements characteristics can also be asked. Example of such may include, predictable work schedule, predictable earning and implicit or explicit contract for continuing relationship. Another improvement from this study could be the development of estimates based on household survey and administrative data that have been integrated at the individual levels such as tax data and business data in order to compare the information from the two sources for the same people. This integration offers great potentials in understanding the changing work arrangements and nature. By linking tax data with LFS for example, information on demographic characteristics of workers and their monthly income can be obtained. Third improvement, is the possible refinement in the information on secondary job from LFS to give a reliable data as gig employment are commonly classifies as secondary activities.

According to Lynn Riggs, Isabelle Sin and Dean Hyslop, measures of gig work ideally would be multi-faceted and easy to aggregate or disaggregate to address a broad array of applications [12]. These measures should go beyond simply counting the number of people engaged in gig work but also include measures of the extent to which people engage in gig work (number of hours, income, transaction volume), and should include multiple timeframes (current, previous month, previous 12 months).

Acknowledgments

We would like to express our appreciation to Dato’ Sri Dr. Mohd Uzir Mahidin, Chief Statistician Malaysia for his encouragement for the authors to participate in the 2020 Asia-Pacific Statistics Week. The assistance and advice provided by Mr. Aloke Kar from Indian Statistical Institute has been a great help in redrafting this research paper. We also would like to thank Ms. Eileen Capilit, Statistician from United Nations Economic and Social Commission for Asia and the Pacific for the time in reviewing and ensuring the quality of this research paper.

References

[1] | Countouris N. Defining and Regulating Work Relations for the Future of Work. 1st ed.: International Labour Organisation; (2019) . |

[2] | Resolution Concerning Statistics of Work, Employment and Labour Underutilization. In 19th International Conference of Labour Statisticians; (2013) ; Geneva. p. 19. |

[3] | Data collection guidelines for ICSE-18. In 20th International Conference of Labour Statisticians; (2018) ; Geneva. p. 67. |

[4] | Donovan SA, Bradley DH, Shimabukuro JO. What Does the Gig Economy Mean for Workers? CRS Report. Congressional Research Service; (2016) . |

[5] | Abraham KG, Sandusky L, Haltiwanger JC, Spletzer JR. [Document].; (2018) [cited 2020 May]. Available from: https://www.aeaweb.org/conference/2019/preliminary/paper/4r9TeS37. |

[6] | Stefano VD. The rise of the “just-in-time workforce”: On-demand work, crowdwork and labour protection in the “gig-economy”. 1st ed.: International Labour Organisation; (2016) . |

[7] | Marr B. Bernard Marr & Co. [Online].; (2019) [cited 2019 May]. Available from: https://bernardmarr.com/default.asp?contentID=1521. |

[8] | ILO. [Article].; (2018) [cited 2019 May]. Available from: https://www.ilo.org/washington/WCMS_642303/lang–en/index.htm. |

[9] | Jeon SH, Liu H, Ostrovsky Y. Measuring the Gig Economy in Canada Using Administrative Data. Research paper. Statistics Canada; (2019) December. Report No.: ISBN 978-0-660-33525-4. |

[10] | Torpey E, Hogan A. U.S. Bureau of Labor Statistics. [Online].; (2016) [cited 2019 May]. Available from: https://www.bls.gov/careeroutlook/2016/article/what-is-the-gig-economy.htm. |

[11] | LaB I, Wooden M. [Document].; (2019) [cited 2020 May]. Available from: https://www.rba.gov.au/publications/confs/2019/pdf/rba-conference-2019-lass-wooden.pdf. |

[12] | Riggs L, Sin I, Hyslop D. Measuring the “gig” economy: Challenges and options. Motu Economic and Public Policy Research. (2019) November; (19-18): 38. |

[13] | Labour Force Survey Report. Publication. Department of Statistics Malaysia; (2020) . Report No.: ISSN: 0128-0503. |

Appendices

Appendix

1. Accountant

2. Actor

3. Advertising Illustrator

4. Aerobics Coach

5. Aerobics Instructor

6. Aesthetician

7. Animator

8. Application Developer (.Net)

9. Architect

10. Artist

11. Audio and Video Equipment Technician

12. Auditing Accountant

13. Barber

14. Beautician

15. Beauty and Health Therapist

16. Biographer

17. Book Illustrator

18. Business Consultant

19. Business Executive

20. Buyer

21. Cameraman/woman (Motion Picture)

22. Canvasser

23. Car Electrical Technician

24. Career Adviser

25. Ceramic Artist

26. Certified Accountant

27. Chef

28. Clown

29. Columnist

30. Commercial Illustration Photographer

31. Commercial Photographer

32. Commodities Broker

33. Computer Games Programmer

34. Computer Programmer

35. Computer Technician

36. Computer Trainer

37. Conference and Event Organizer

38. Construction Supervisor

39. Creative Designer

40. Customer Contact Centre Salesperson

41. Dance Instructor

42. Dance Teacher

43. Dancer

44. Database Designer

45. Debt Collector

46. Demonstrator

47. Designer

48. Despatch

49. Direct Selling Salesperson

50. Domestic Housekeeper

51. Door to Door Salesperson

52. Drama Teacher

53. Draughtsperson

54. Driver, Car

55. Driver, Other Car, Taxi and Van

56. Driver, Taxi

57. Driving Instructor

58. Editor

59. Educational Methods Adviser

60. Electrical Technician

61. Electronics Engineering Technician

62. Employment Agent

63. ERP Programmer Analyst

64. Exhibition and Convention Consultant

65. Exhibition and Convention Organizer

66. Fashion Designer

67. Fashion Model

68. Field Consultant

69. Film and Video Editor

70. Financial and Investment Adviser

71. Financial Planner

72. Fine Art Engraver-Etcher

73. Fine Arts Teacher

74. Fitness Instructor

75. Flower Decorator

76. Food and Beverage Worker

77. Food and Beverage Worker, Banquet

78. Foreign Exchange Broker

79. Foreign Exchange Dealer

80. Forwarding Agent

81. Garment Designer

82. Graphic Designer

83. Group Exercise Instructor & Coordinator

84. Hair Stylist

85. Hairdresser

86. Hardware Technician

87. Housekeeper, Private

88. Housekeeping Worker, Private

89. Industrial Products Designer

90. Information Technology Consultant

91. Information Technology Consultant (Java)

92. Information Technology Programmer

93. Instrumentalist

94. Insurance Agent

95. Insurance Broker

96. Insurance Consultant

97. Insurance Representative

98. Intensive Language Teacher

99. Interior Decorator

100. Interior Designer

101. Internet Salesperson

102. Interpreter

103. Investment Analyst

104. Investment Broker

105. Investment Consultant

106. Islamic Education Teacher

107. Islamic Religion Teacher

108. Journalist

109. Labour Contractor

110. Land Surveyor

111. Landscape Architect

112. Landscape Artist

113. Learning Support Teacher

114. Lighting Technician

115. Machine Technician

116. Magician

117. Maintenance Technician

118. Make-Up Artist

119. Management Consultant

120. Manicurist

121. Metalwork Ornamental Designer

122. Motorcyclist

123. Multimedia Designer

124. Music Teacher

125. Musical Performance Agent

126. Musician

127. Network Services Consultant

128. Newsagent

129. Novelist

130. Operation Supervisor

131. Packaging Designer

132. Paint Artist

133. Painting Teacher

134. Pawnbroker

135. Pedicurist

136. Personal Trainer

137. Personnel Consultant

138. Photographer

139. Physical Fitness Instructor

140. Portrait Painter

141. Primary School Teacher

142. Private Investigator

143. Procurement Agent

144. Producer, Television

145. Project Supervisor

146. Property Agent

147. Property Negotiator

148. Public Accountant

149. Purchasing Agent

150. Quality Control Inspector

151. Quantity Surveyor

152. Real Estate Agent

153. Real Estate Appraiser

154. Real Estate Salesperson

155. Referee

156. Religious Education Teacher

157. Rent Collector

158. Rental Salesperson

159. Sales Promoter

160. Sales Representative

161. Sales Representative, Medical Hardware

162. Salesperson

163. Salesperson, Business Services Advertising

164. Salesperson, Car

165. Salesperson, Motor Vehicle

166. Salesperson, Technical

167. Salesperson, Travel

168. Second Language Teacher

169. Secondary Education Teacher

170. Shipping Agent

171. Singer

172. Singing Teacher

173. Skill Training Trainer

174. Social Welfare Worker

175. Social Worker

176. Social Worker, Child Welfare

177. Social Worker, Community

178. Software Designer

179. Software Developer

180. Software Engineer (SharePoint) (IT)

181. Software Programmer

182. Sound Programmer

183. Spa Masseur

184. Spa Therapist

185. Sports Coach

186. Sports Instructor

187. Stock and Shares Broker

188. Sub Editor

189. Surveying Technician

190. Surveyor

191. Systems Programmer

192. Taekwando Coach

193. Tax Consultant

194. Teacher, Home Economics

195. Technical Sales Agent

196. Technical Sales Representative

197. Technical Service Adviser

198. Technician

199. Telecommunications Technician

200. Telemarketer

201. Telesales Agent

202. Tennis Coach

203. Tourist Guide

204. Training Consultant

205. Translator

206. Travel Agent

207. Travel Consultant

208. Tuition Teacher

209. Tutor

210. Typographical Designer

211. Ustaz/Ustazah

212. Videographer

213. Web Designer

214. Web Programmer (PHP)

215. Website Developer

216. Website Technician

217. Wedding Planner

218. Yoga Coach